Once more, and as expected, Seattle home prices increased towards the end of 2019, perhaps signaling that assumptions from local real estate analysts that the leveling we saw around September was a “new normal” were incorrect. To be fair, those analysts shouldn’t be derided for those assumptions; nationally we were seeing a slow down, and now we’re seeing that there was in fact a national increase in activity and pricing towards the end of the year.

So, let’s get into the numbers and see if we can draw some conclusions from the data.

The information and data to support our analysis comes from the S&P CoreLogic Case-Shiller Home Price Index.

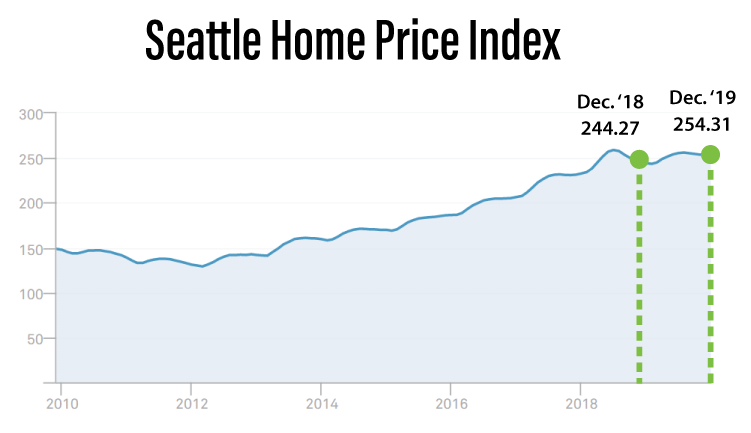

Seattle home prices in December 2019 showed an increase over the prior 2-3 months of slow growth. December 2018 to December 2019 Seattle home prices increased by 3.95%, erasing the steadying to modest recession of Seattle home prices of -.8% from September to November. On an annualized basis, Seattle home prices increased by 4.11% from 2018 to 2019.

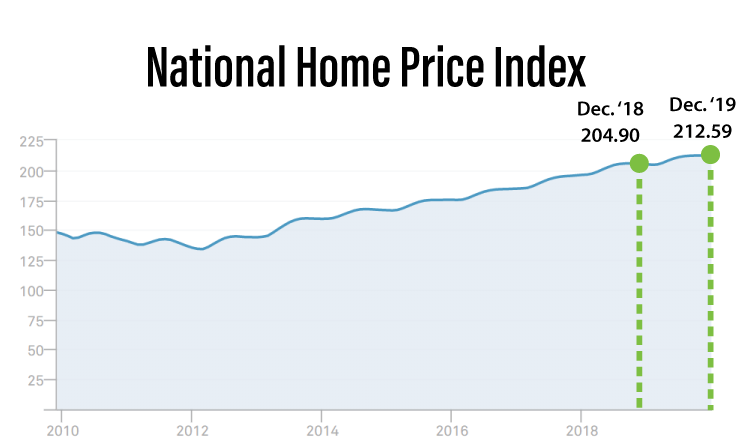

At this point, we should be asking if this is a local market occurrence or if we’re seeing similar patterns on a national scale. The answer is that we are seeing these trends across the nation. Nationally home prices increased 3.61% from December 2018 to December 2019, and they increased by 3.75% on an annualized basis. While Seattle home prices increased in concert with trends seen across the nation, the Seattle real estate market did outpace the national average, and it should be noted that King County is one of the most expensive counties in the country by median home price. So, a 4.11% increase is significantly felt.

What does this mean for long term expectations?

Well, from a trend standpoint, and given what occurred in the months preceding December, it’s too early to tell if we are done with the short steadying we saw or if December was a minor blip before the more active Spring season begins. What we can do, however, is look at economic factors that otherwise drive home prices outside of lending and mortgage rates; we can look at very specific local factors. There is still significant business growth occurring on the East Side, construction of the light rail connecting Seattle commuters to outside suburbs is in full swing, and new data shows fewer people are relocating than in prior generations. All of those things tell us that Seattle home prices should continue to increase regardless of variables like lending rates.

What does this mean for your real estate investing strategy?

As we mentioned in a prior post, given the growing number of renters from the millennial demographic and an expected, consistent growth in Seattle home prices, margins will continue to become slimmer and slimmer in the house flipping market. Buy and hold (BRRRR method) should begin playing a larger role in investment portfolio strategies to mitigate risk on flipping investments through constant cash flow.

If you’d like to learn more about buy and hold as well as other real estate investing methods, sign up for our Investor 101 class, or you could visit some of our posted webinars.