The market update data from the NWMLS for performance in the real estate market for the month of December is in, and the data is proving some of our earlier predictions to be coming true. Those pending sales that we’ve been talking about since this past October are now impacting the Greater Seattle housing market and in a significant way. While some analysts were referring to the lull in September as a possible “new normal,” we were reluctant to assume any tapering in the real estate market and in real estate prices just yet. We were reluctant because economic performance continues to surpass expectations, we have not seen any large scale ramifications from supposed trade wars, and business growth continues in the Puget Sound region.

One thing is for certain, if you are a buyer currently in the market, continue searching through these winter months. While price could still fluctuate based on economic factors such as lending rates, inventory will not be bouncing back any time soon, and demand will be the most significant driver of price increases. Take advantage of favorable interest rates, and try to beat the motivated spring buyers.

Let’s dig into some of the high level metrics of real estate performance in this market update.

It’s Been a Hot Winter

While December is traditionally a slow month in real estate, which is marked by lower inventory, this December was particularly noteworthy because it was not slow. The activity of the last several months maintained the heightened pace into December, and as a result, there was a 31% decrease in inventory from December 2018. King county saw one of the most dramatic year over year changes with a 38.75% decrease in active listings — there were only 2,260 active listings in the month of December for King county.

As further proof that activity is uncharacteristically high through these winter months, inventory is at record lows.

Those are NWMLS system wide numbers. For King, Snohomish, Pierce, and Kitsap counties, there was under one month of inventory available. That’s a 35% decline from the same time a year ago. This constriction on inventory is a driving factor in rental prices increasing currently. For this reason, as well as some other economic indicators, we posted an article suggesting buy and hold investing as opposed to flipping; check it out here.

From the NWMLS:

. . . more and more of their buyers do not work in Kitsap, adding areas connected to the ferry system are seeing more and more commuters purchase homes “because we are still more affordable than King County with a much higher quality of life.” He also said, “The unheard story out there is the one of many sellers who would like to sell their home but cannot find a home to buy in Kitsap.”

Action Drives Price Increases

While those increases aren’t jaw dropping given our experience in this market over the last 5 years, it’s still impressive to see this much activity in December, and prices are reflecting the increased activity. The four Puget Sound counties specifically saw a 10% increase over the same time a year ago. A solid economy with steady job growth and low unemployment (King county saw unemployment drop to 2.3% in November ’19) is a strong indicator that price will continue to be driven by the inventory squeeze.

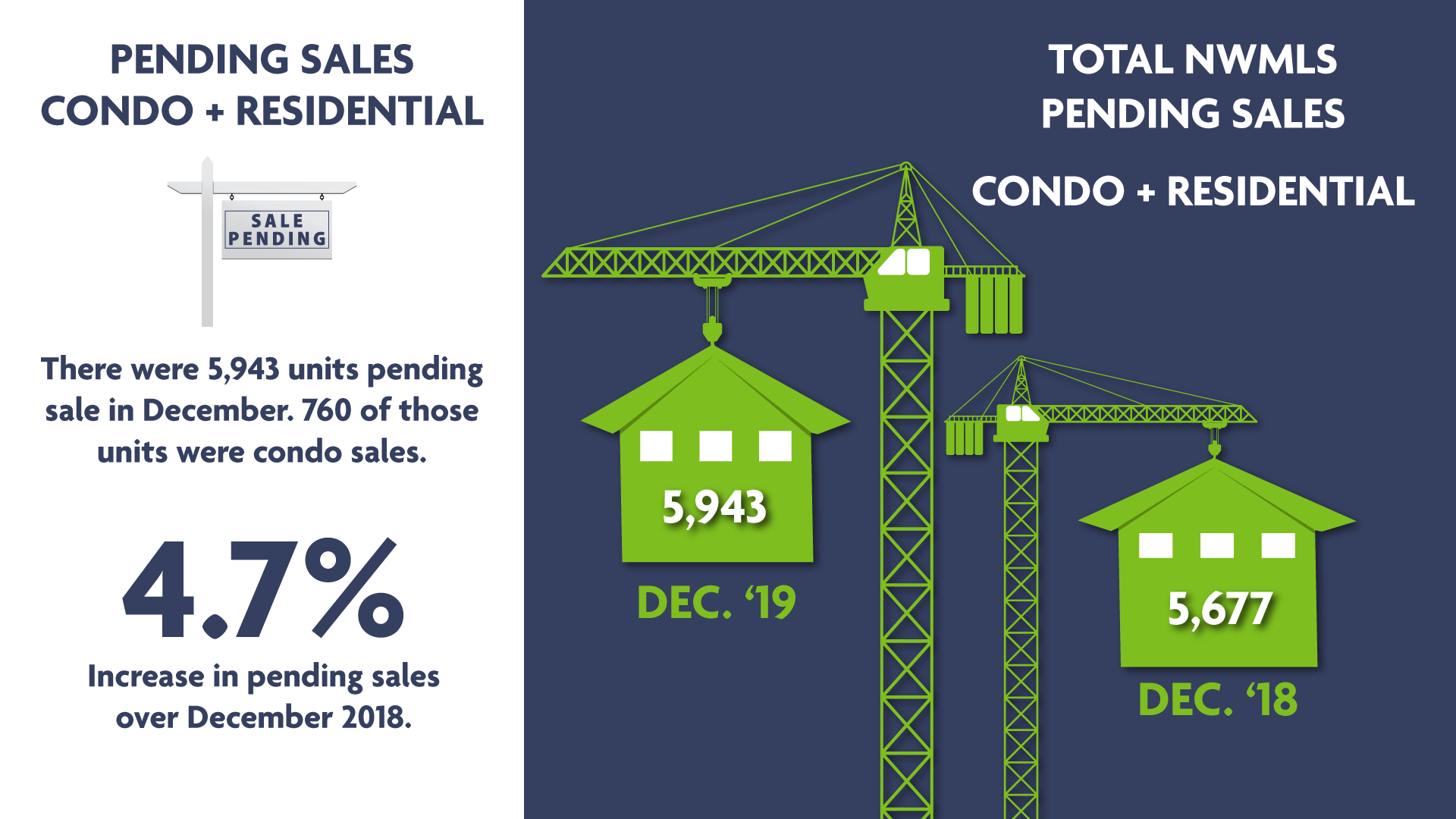

Pending Sales Still on the Rise

An increase in pending sales has as expected resulted in higher sales, and December is no different. With an increase in year-over-year pending sales, we expect 2020 to get off to a fast start, and that pace will continue into the spring.

Learn more about buy and hold.

For more information on real estate investment, check out our webinars.

If you are interested in learning more about our process, sign up for our Investor 101 class.