Low inventory. That’s the takeaway from the latest statistics released by the NWMLS, and it’s something that we should look at as an indicator for the future of the Puget Sound market. Inventory seemingly cannot keep up with the influx of new residents as the region continues its economic expansion thanks largely in part to the likes of Google, Amazon, Apple, and Facebook, and we’re seeing the most significant impact in the East Side neighborhoods.

Let’s dive into the numbers.

INVENTORY IS DRIVING COMPETITION

With numerous outlets ranking Washington state as one of the 5 fastest growing states by population in the country – Business Insider recently ranked Seattle in the top 25 of fastest growing economies, which is impressive for an already densely populated and economically developed area – housing inventory is seeing trending lows on a month-by-month as well as a year-over-year basis.

In October 2019, In King County alone, we saw nearly 1,500 fewer active listings when compared to October 2018, and according to the NWMLS, 18 of the 23 Washington counties saw a double-digit decline in active listings.

From the NWMLS:

Compared to the same month a year ago, October’s supply of active listings declined by double-digits in 18 of the 23 counties in the NWMLS report. Thurston County had the sharpest decline (down 35.5%), followed by Pierce (down 28.7%) and Kitsap (down nearly 27%).

How Do We Know There Is Still High Demand Despite Low Inventory?

There are several factors that prove demand is still high and climbing. One of them is inventory turnover (the amount of time in months it would take to exhaust the full supply of NWMLS listings at current market pace), and the rate of turnover continues to increase.

There are 10 counties, all of which are within the Puget Sound region, that have under two months of inventory available. Of the 23 Washington counties, 20 of them have less inventory than the nation-wide standard of 4 – 6 months. System wide, inventory dropped by approximately 15 days of available inventory compared to October 2018.

Are We Seeing Low Inventory Affect Sales Prices?

That’s a complex question, and it’s one that will require us to wait and continue to watch the market before we can develop an accurate conclusion. As stated above, a booming population and economic growth plus low inventory will all be contributing factors to median home prices; however, we cannot ignore national economic factors such as interest rates on mortgages remaining at historic lows. With that said, we are seeing significant increases in certain areas, but it is too soon to say if that is in fact the new normal.

The system wide median price increased 7.7%, but that’s a number that needs further dissection to truly understand the growth pattern as it pertains to geography.

For instance, King county was one of only two counties to see a year-over-year drop in median price (-1.4%), but there has been dramatic fluctuation within King County. The Seattle Submarkets are driving the majority of the King County decline with Vashon being the largest driver at a nearly 20% drop in median prices. To counter that decline, Bellevue west of I-405 is seeing an explosion of median prices – year-over-year median prices have jumped 21% with the average selling price coming in at $1,892,500.

Are Higher Prices Scaring Away Buyers?

The short answer is a resounding “no“.

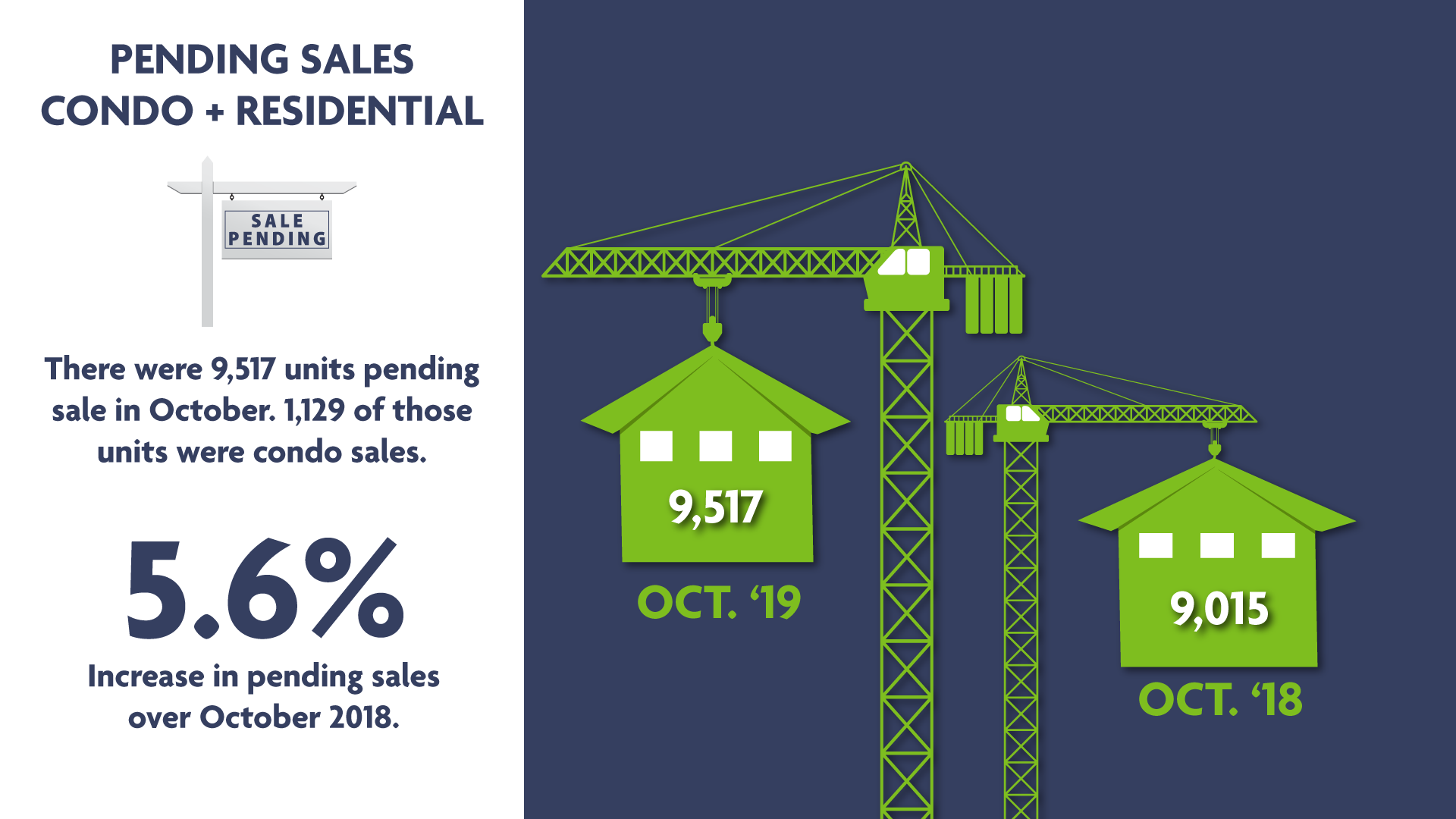

Similar to what we said in last month’s market update, pending sales are still on the rise and exceeding year-over-year numbers.

From the NWMLS:

Despite the slim selection, demand was strong as the volume of pending sales (9,517) outgained the number of new listings added during October (8,394). Nine counties reported double-digit jumps in pending sales compared to 12 months ago.

All data suggests that current trends in inventory levels and sales prices will persist. While that sounds like a daunting future to perspective buyers, relief through interest rates and lending institutions competing for buyers’ business is giving them some leverage, but it is still very much a seller’s market, and any perspective buyer should, at the very least, find comfort in the knowledge that buying a home in nearly any market in Washington will result in their property growing in value over the near future and provide the homeowners with positive equity as well as comfortable negotiating position when it comes time for them to re-sell.

To see a full listing of our available properties, click here.

To learn more about real estate investing from the co-founder of Heaton Dainard, click here.