We’re headlong into the autumn season, and with the dropping of temperatures, inventory has dropped as expected; however, we saw some very interesting trends in September that have speculators scratching their heads a bit. What generally tends to be a period of easing in the market turned out to be more of a rollercoaster with dramatic ups and dramatic downs in specific year-over-year categories that require more of an analytic approach to truly identify a trend. So, let’s dive into the numbers!

Traditional Indicators

As expected, when the year is drawing to a close, inventory tends to decline as unsold homes come off the market, and while this year followed that rule of thumb, we need to make sure we’re looking at the data through the appropriate lens. With the Greater Seattle region experiencing a real estate boom over the past several years, looking at indicators on a year-over-year basis can be misleading.

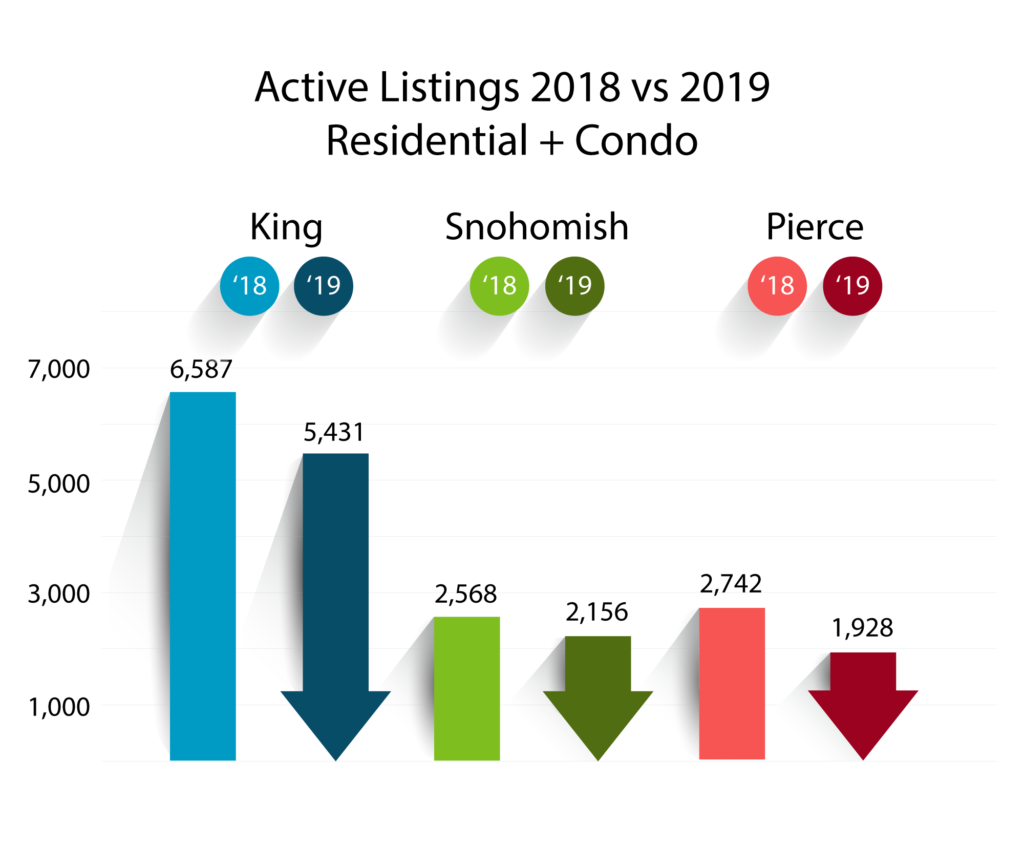

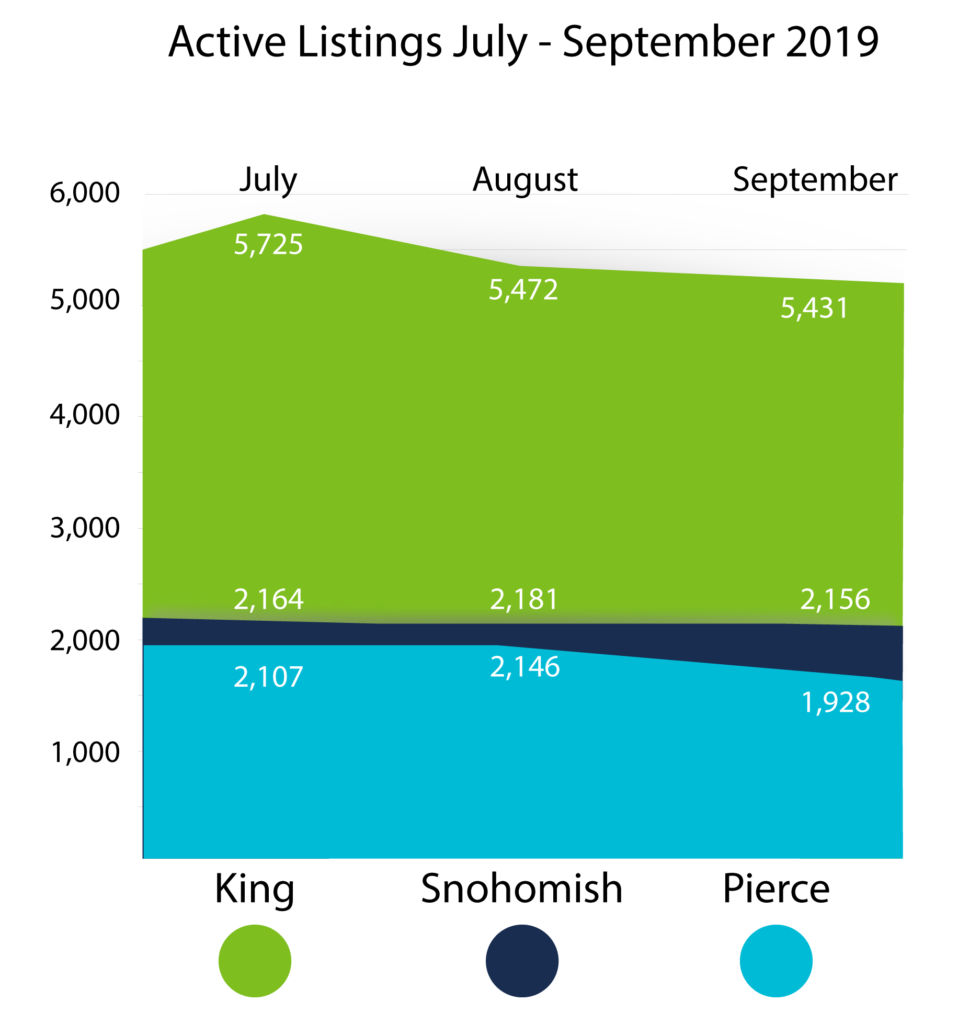

Case in point: the NWMLS reported a system-wide drop of 18% in inventory compared to September 2018.

But considering the Greater Seattle market has been one of the hottest housing markets in the country over the last 4 – 5 years, that’s not necessarily an indicator of a drop in the market. When viewed as part of rolling data in this year, King and Snohomish counties have stayed relatively flat compared to July and August of this year with Pierce county showing the typical Fall inventory drop-off.

What does this tell us? It tells us that there are still plenty of motivated buyers. That’s supported by the fact that pending sales are currently outpacing new listings, and if we look at the current trend in median home prices in King County, which saw a 3% decrease to $593,750 year-over-year, we can only assume this will contribute to buyers remaining motivated

If prices are dropping, doesn’t that mean the market is slowing?

In theory, a dip in prices could mean a market slow-down, or at the very least, a market stabilization. Because the Puget Sound region is so unique in its geography, and it’s a commuter-heavy population, we must expand our view to surrounding areas, counties, and sub-markets to thoroughly understand the trend. While prices in King County specifically have decreased year-over-year, NWMLS system-wide prices have increased, and only two of the six King County sub-markets are contributing to the entirety of the price drop in that county. Seattle is down 3.2%, and Vashon is down nearly 28%! Additionally, residential prices have remained virtually flat in a year-over-year and 3-month rolling analysis, but condo median prices have dropped over $25,000 year-over-year – they remain flat on a 3-month rolling analysis.

What is causing this fluctuation, and what can we expect from here?

It appears that we are seeing more of a stabilization, but it won’t be an accelerated stabilization. The Puget Sound region will remain a hot-spot compared to national markets. Historically low interest rates are contributing to more driven buyers, and it’s also allowing younger buyers to enter the market. Because of that, a drop in inventory has not dissuaded buyers, and the fact that prices have risen in areas outside of the Seattle Metro area confirms that a younger pool of buyers is searching for homes in the surrounding areas, and that is what appears to be lowering prices in select sub-markets. And again, 2018 was a highly active year, so it would be inappropriate to assume that level of activity would be sustainable. Inventory supply increased slightly, but analyst consider 4 to 6 months of inventory to be a stable market, and the Puget Sound is significantly below that with system wide inventory supply sitting at 2.56 months.

This is still very much a seller’s market . . . buyers are simply finding some relief through other economic means through a shift in search areas and the aforementioned lending rates. And, once again, the large increase in pending sales could make for a hotter than usual Fall market. With the increased presence of Google, Microsoft, Facebook adding a new campus, and soon Amazon coming to the East Side, there is more reason to expect the real estate market to pick up steam again rather than slow down.

As mentioned above, younger buyers are becoming more motivated, and we at Heaton Dainard have recognized the need for education and assistance for first time home buyers. We will soon be building an entire education and course-driven program to help guide first time home buyers through the buying process. So, contact us to stay posted on what that program goes live!

If you’re realizing that this is still a very attractive market to invest in real estate, which it is, then consider attending our Investor 101 seminar that’s hosted by Heaton Dainard co-founder James Dainard. In that seminar, James goes over investment strategy, financing, as well as pitfalls and mistakes to avoid.